It’s been an interesting (and increasingly expensive!) couple of years watching travel costs, as the AmTrav team covered in our 2023 travel cost forecast webinar, travel savings webinar, and recently in our GBTA preview webinar.

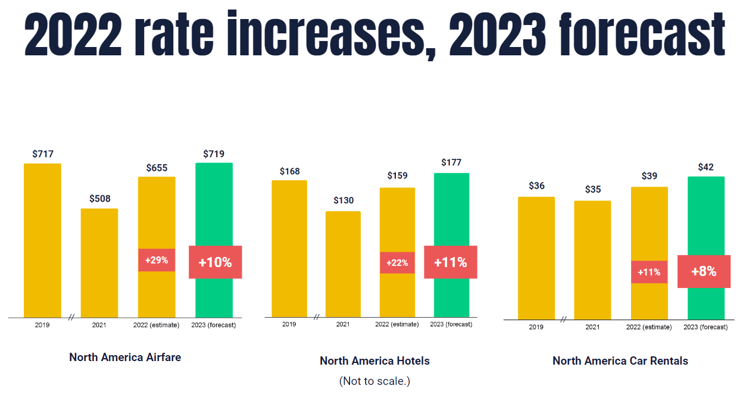

Data from AmTrav's 2023 travel cost forecast webinar. Source was GBTA 2023 travel cost forecast.

In that most recent webinar previewing GBTA, we updated customers and other buyers on trends we’re seeing: in short, at long last travel cost increases are cooling.

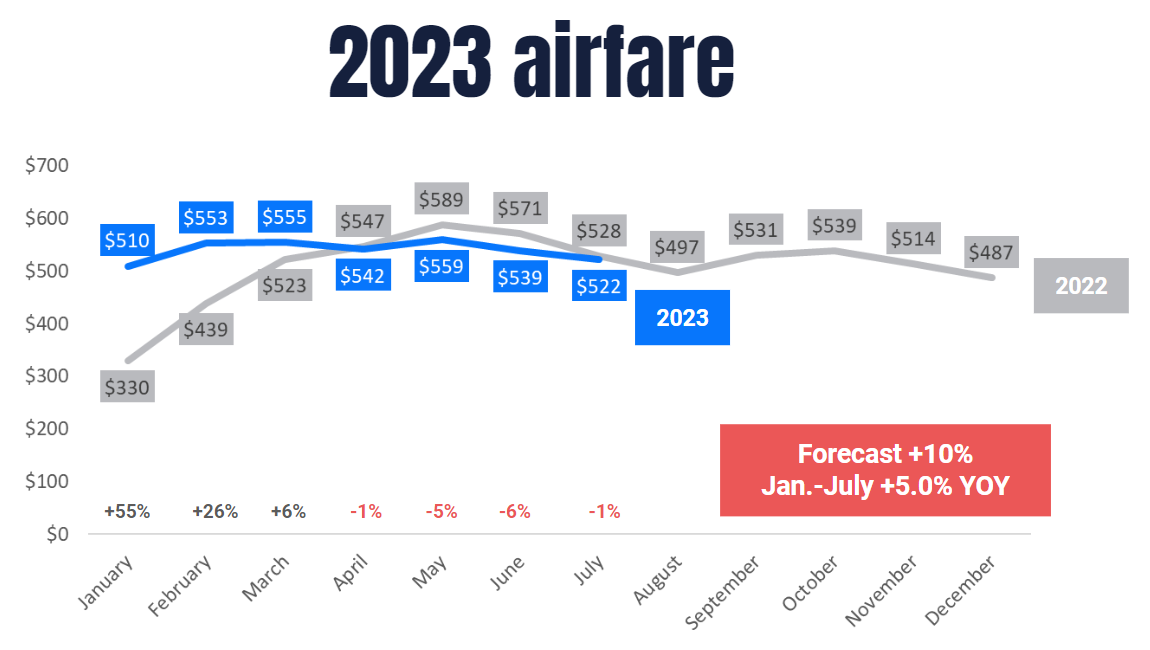

Airfare

Airfare is the big story. After a 29% increase in fares from 2021 to 2022 and a forecast 10% jump from 2022 to 2023, airfare has only increased 5% in January-July of 2023.

What happened? We lapped the January-February 2022 Omicron time period where demand and pricing were depressed, fares increased by 40% in those months. But then year-over-year fare increases leveled off starting in March, in fact dropping slightly in several months since. (In retrospect we might have seen this coming if we'd checked the 2022 fares by month.)

One big question is whether business travel demand will rebound to offset leisure demand that naturally declines as school resumes in the fall. We’ll see that in fares sold in August, September, and October. A second big question is whether airlines have restored enough capacity to meet demand: the year-over-year fare decreases since April point to that supply-demand equilibrium and continued softness would support that hypothesis.

Data source: AmTrav corporate customer bookings, 2022 and 2023.

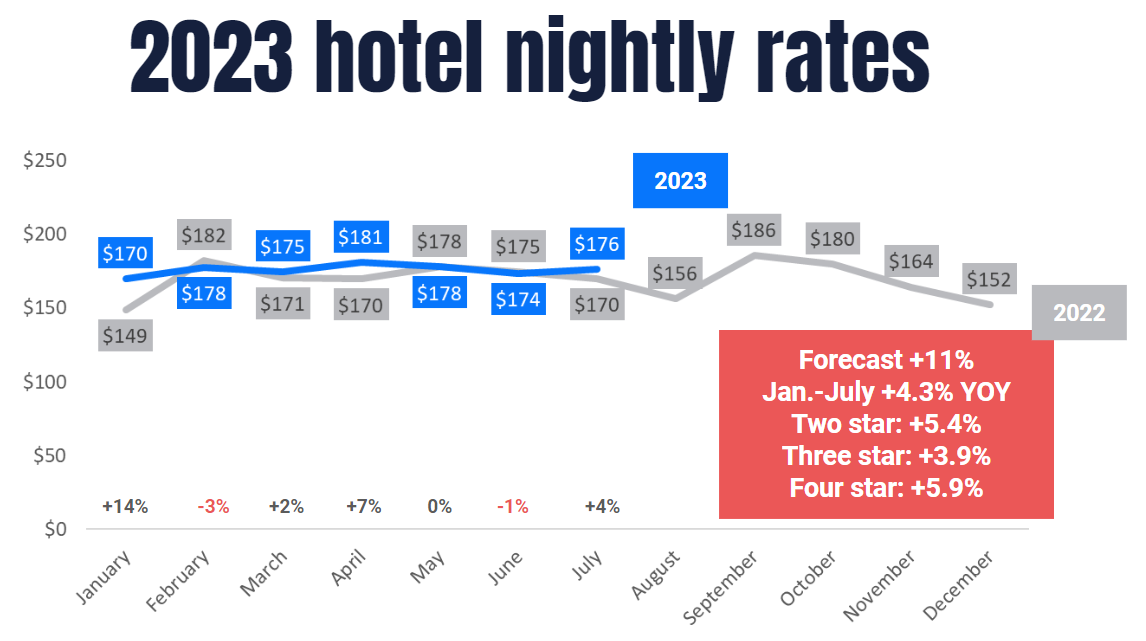

Hotel Rates

Hotels showed a similar trend but without quite as big a January-February jump. Nightly rates increased 22% from 2021 to 2022 and were forecast 11% from 2022 to 2023, but rates have only increased 4% in January-July of 2023. Like airfare after February, hotel nightly rates haven’t moved dramatically. Through the end of the year, it will be interesting to see if the increase in September and then steady decline through fall into December repeats.

Data source: AmTrav corporate customer bookings, 2022 and 2023.

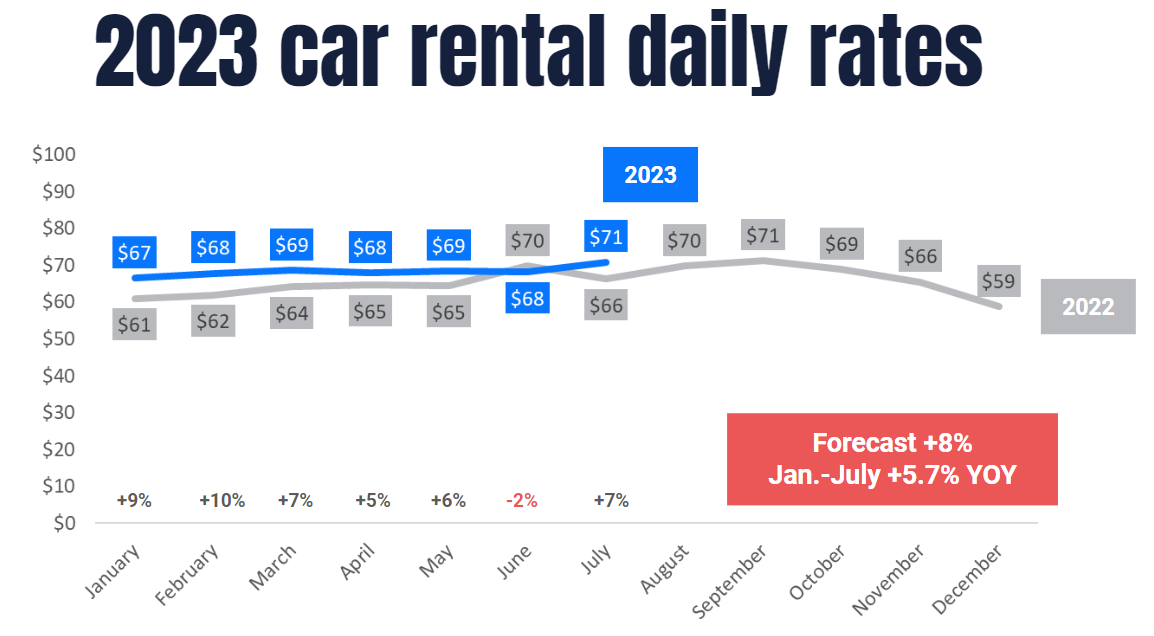

Car rental Rates

Car rentals have the lowest forecast daily rate increase for 2023 but the highest actual rate increase through July: increased by 6% against a forecast of 8%. (Such is forecasting, you’re wrong more often than you’re right!) We’ll see if rates follow the gradual decline that we saw in September-December 2022, if rates don't decline similarly then car rental daily rates could continue leading the pack.

Data source: AmTrav corporate customer bookings, 2022 and 2023.

Elliott McNamee